The question hit me like a gust of wind on a chilly Chicago morning, as I sat in my rented downtown apartment, scrolling through Zillow listings with a steaming mug of coffee. My lease was nearing its end, and the crossroads loomed: keep renting my cozy one-bedroom with a view of Lake Michigan, or dive into the daunting world of homeownership? In 2025, the U.S. housing market feels like a rollercoaster—skyrocketing prices in some cities, cooling trends in others, and interest rates that make every decision feel like a gamble. As I dug into the numbers, talked to friends, and weighed my options, I uncovered a story of costs, dreams, and trade-offs that define the rent-versus-buy debate. Here’s what I learned, told through a point-wise journey from a U.S. perspective, to help you decide which path makes financial sense today.

1. The 2025 U.S. Housing Market: A Shifting Landscape

The U.S. housing market in 2025 is a whirlwind of opportunity and uncertainty, shaped by economic tides that ripple through every decision. I remember my neighbor, a real estate agent, describing it as a chess game where every move counts. Median home prices have climbed to $412,000, up 5.8% from 2024, per the National Association of Realtors, driven by low inventory and high demand in cities like Austin and Raleigh. Rents are no picnic either—urban hubs like Chicago see 6–8% annual rent hikes, with a one-bedroom averaging $2,000/month. Interest rates, hovering at 5.5–6.5% for 30-year mortgages, squeeze buyers, while inflation (around 3%) nibbles at savings. Whether you rent or buy, understanding this landscape is your first step.

2. Upfront Costs: The Price of Entry

Buying a home felt like staring up a mountain. For a $400,000 starter home—common in suburbs like Charlotte, NC—a 20% down payment means $80,000, plus 2–5% in closing costs ($8,000–$20,000). Add inspections, appraisals, and moving, and you’re out $90,000–$100,000 before keys hit your hand. My savings account winced at the thought. Renting, by contrast, was a lighter lift: a $2,000 security deposit and first month’s rent of $1,800 got me into my Chicago apartment. For young professionals or those rebuilding finances post-pandemic, renting’s low upfront cost preserves cash for emergencies or investments like ETFs, which averaged 10% returns in 2024.

3. Monthly Cash Flow: Rent vs. Mortgage Payments

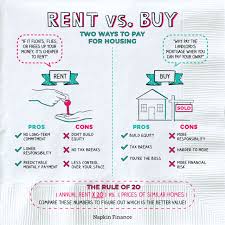

I crunched the numbers on a $400,000 home with a $320,000 mortgage at 6% over 30 years. The monthly payment? About $2,400, including taxes and insurance—nearly double my $1,800 rent. Renting left room for dining out, gym memberships, and Roth IRA contributions, while buying would stretch my budget thin. But my friend Emma, a homeowner in Denver, pointed out a twist: rents rise 5–8% annually in hot markets, potentially hitting $3,000 in a decade, while a fixed-rate mortgage stays steady. Buyers face extra costs, though—maintenance (1–2% of home value yearly, or $4,000–$8,000) and HOA fees ($200–$500/month in condos). For now, renting’s predictability felt like a financial breather.

4. Wealth Building: Equity vs. Flexibility

Homeownership is often pitched as a wealth-building machine, and there’s truth to it. My uncle bought a Seattle home for $200,000 in 2000; it’s worth $1 million today. In 2025, U.S. home prices grow 4–6% annually in growing markets, per Redfin, building equity over time. Tax breaks sweeten the deal—mortgage interest deductions (up to $750,000 in debt) and property tax write-offs saved my cousin $5,000 last year. Renting, though, keeps your money liquid. I could invest my savings in a Vanguard S&P 500 fund, averaging 8–10% returns, without tying up $80,000 in a down payment. The catch? Renters build no equity, and I felt that sting imagining years of rent vanishing into my landlord’s pocket.

5. Lifestyle and Mobility: Freedom to Roam

At 32, I’m not ready to settle down. My tech job could shift me to Austin or San Francisco, and renting lets me break a lease with 30 days’ notice. My friend Jake, who rented in Miami, moved to New York for a promotion without a hitch. Selling a home, though, takes months and costs 5–6% in realtor fees ($20,000–$24,000 on a $400,000 home). In 2025, remote and hybrid work make mobility key—40% of U.S. workers have flexible arrangements, per Gallup. Renting suits nomads, while buying fits those craving roots, like my sister who bought a fixer-upper in Portland to raise her kids near family.

6. Market Risks: Navigating Uncertainty

The market’s ups and downs kept me awake. Interest rates at 6% make mortgages pricier, and a potential economic slowdown could stall home price growth. I read about 2008, when homeowners faced underwater mortgages as values plummeted. Renting shields you from market crashes—you can walk away if rents spike or neighborhoods decline. Buyers risk illiquidity; a 2024 Redfin survey found 25% of U.S. homeowners felt “trapped” by high rates and low equity. In 2025, cooling markets in places like San Francisco (2% price growth) contrast with hot spots like Boise (8% growth), making location a risk factor.

7. Long-Term Costs:

The 20-Year PictureI projected costs over 20 years, and the numbers told a story. Renting at $1,800/month, with 6% annual increases, totals $720,000 by 2045. A $400,000 home with a $320,000 mortgage at 6% costs $576,000 in payments, plus $80,000–$160,000 in maintenance and taxes. But the home could be worth $800,000, assuming 4% annual appreciation, yielding a net gain. Renting saves upfront but drains wealth long-term, while buying’s high initial cost builds an asset. The Wall Street Journal notes that in high-growth U.S. cities, buying often beats renting over 15+ years, but short-term renters stay agile.

8. Emotional and Social Weight: More Than MoneyBuying a home feels like a rite of passage. My parents beamed recounting their first Chicago bungalow, a symbol of the American Dream. In the U.S., homeownership is culturally celebrated—friends asked why I “threw away” money on rent. Yet, renting offered peace; when my water heater broke, my landlord handled it. Homeownership brings pride but also stress—repairs, mortgage payments, and market swings. A 2024 Zillow survey found 30% of U.S. buyers felt “house poor,” regretting tight budgets. For me, renting’s simplicity let me focus on career and travel, unburdened by a fixer-upper’s demands.

9. Location Matters: Urban vs. Suburban Dynamics

Where you live shifts the equation. In Chicago’s Loop, median home prices hit $450,000, with condos at $3,000/sq.ft., making renting a $2,000 one-bedroom more practical. In suburbs like Naperville, homes cost $350,000 (2–3% rental yield), favoring buyers who plan to stay. I explored Raleigh, where homes at $1,500/sq.ft. and 5% appreciation make buying tempting, per Zillow. In 2025, secondary cities like Boise offer affordability ($300,000 median), while coastal hubs like San Francisco ($1.2 million) push renters to the sidelines. Your city—urban buzz or suburban calm—sways the decision.

10. Alternative Investments: Diversifying WealthRenting frees cash for other ventures. My coworker Sarah rents in Austin and invests in REITs via Fundrise, earning 7–9% dividends without property hassles. Platforms like Robinhood let me buy fractional shares in real estate ETFs for $100, offering returns without a mortgage. Buying locks capital in one asset, vulnerable to market dips. In 2025, with stock markets averaging 8–10% returns, renting and investing the difference can match home equity growth, especially for short-term horizons. I leaned toward this, eyeing a diversified portfolio over a single property.

11. Tax Implications: The Hidden PerksTax benefits nudged me toward buying. Mortgage interest deductions (up to $750,000) and property tax write-offs (up to $10,000) can save $3,000–$8,000 annually, per IRS rules. My friend in Denver saved $6,000 last year on taxes, offsetting his mortgage costs. Renters get no federal breaks, though some states offer renter tax credits (e.g., $500 in Illinois). Over 10 years, buying’s tax savings could cover $30,000–$80,000 of loan costs. But tax laws shift—potential 2025 changes to deductions worried me, making renting’s simplicity a safer bet for now.

12. The 2025 U.S. Context: Opportunities and ChallengesThe U.S. in 2025 is a mixed bag. High interest rates (6–6.5%) raise borrowing costs, but cooling markets in suburbs offer deals—Phoenix saw 3% price growth in 2024, per Redfin. Proposed federal programs, like a $15,000 first-time buyer tax credit, could boost demand, pushing prices up. Proptech like Redfin’s virtual tours and Rocket Mortgage’s digital loans simplify buying, while apps like Apartments.com streamline renting. Remote work fuels demand in affordable cities like Charlotte, where prices rose 7%. Timing, location, and strategy shape your choice in this pivotal year.

Conclusion

As I sipped my coffee, gazing at Chicago’s skyline, the rent-vs-buy question felt less like a math problem and more like a chapter in my story. Renting offers freedom, liquidity, and low upfront costs, perfect for my mobile, career-focused life in 2025. Buying builds equity, tax savings, and pride, appealing to my dream of a home to call mine. The financial edge depends on your timeline—renting suits 1–5-year flexibility, while buying shines over 10+ years in growing markets. Crunch the numbers, reflect on your lifestyle, and trust your instincts. For me, renting won for now, but the vision of a home—my own slice of the American Dream—still sparkles, waiting for the right moment to shine.