When I was a young financial advisor just starting my career in Boston, I met a man named Robert who taught me more about retirement planning than any textbook ever could. Robert was in his early sixties, a successful engineer, the kind of person you’d expect to have his financial future perfectly sorted. But the truth was, he had no clear plan for his retirement. He had savings scattered in different accounts, a modest 401(k), and a vague idea that Social Security would take care of the rest. His plan—if you could call it that—was built on hope, not strategy.

We spent weeks working together, mapping out what his retirement would actually look like. We talked about the home he wanted to keep, the travel dreams he and his wife shared, and the possibility of helping his grandchildren through college. It was only when we put real numbers to those dreams that Robert realized how much more intentional his financial decisions needed to be.

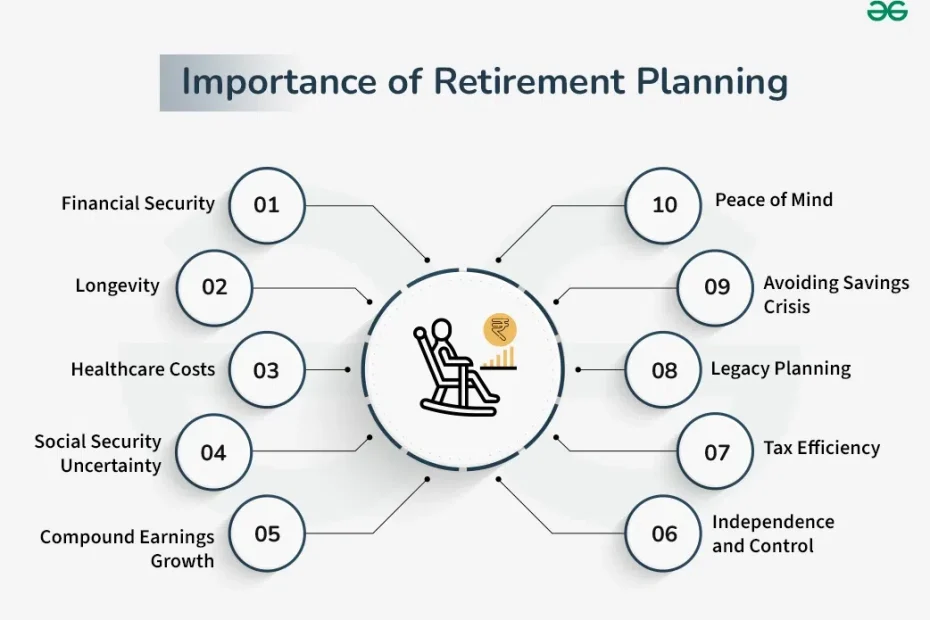

That’s the thing about retirement—it’s not just about quitting your job; it’s about replacing your paycheck with a reliable income stream you can live on for decades. And in the United States, that requires understanding a few moving parts: how much you’ll need, how long you’ll need it, and how to protect it against inflation, taxes, and unexpected expenses.

One of the first lessons I share with anyone is that retirement planning should start as early as possible. If you’re in your twenties or thirties, every dollar you save and invest now has decades to grow thanks to the magic of compounding. But even if you’re starting later, like Robert, it’s never too late to take action—you just have to be more strategic. For younger savers, maxing out contributions to tax-advantaged accounts like 401(k)s and IRAs is essential. For those closer to retirement, shifting the focus toward income stability and asset protection becomes the priority.

I remember sitting down with Robert and breaking his retirement into stages. In the early years, he wanted to travel more, so we planned for higher spending in that phase. Later, when travel would slow down, his expenses would naturally decrease. By visualizing retirement in phases, we could align his investments, Social Security benefits, and personal savings to make sure he never ran short.

We also talked about healthcare—an often underestimated expense. Medicare provides a foundation, but it doesn’t cover everything. We factored in supplemental insurance and potential long-term care needs so that one medical emergency wouldn’t derail his entire plan.

Perhaps the most eye-opening moment for Robert came when we discussed taxes. He had assumed that retirement meant lower taxes, but with his income from investments, Social Security, and part-time consulting work, his tax bill could still be significant. By strategically withdrawing from different accounts and using Roth conversions, we were able to reduce his lifetime tax liability.

By the time we finished, Robert didn’t just have a financial plan—he had a retirement blueprint. He knew how much he could spend each year, where his income would come from, and how to adjust if life threw a curveball.

When I think back on that experience, I realize retirement planning isn’t about numbers alone—it’s about turning your vision for the future into something tangible and achievable. It’s about creating the freedom to live life on your own terms, whether that means traveling the world, spoiling your grandkids, or simply enjoying quiet mornings with a cup of coffee and no commute.

For every American, the path to a secure retirement is different, but the foundation is the same: start planning early, save consistently, invest wisely, and adapt your strategy as life changes. If you take the time to build that foundation, your retirement years can be everything you’ve imagined—and more.

U.S. Retirement Planning Checklist – Step-by-Step

Step 1: Determine Your Retirement Age & Lifestyle Goals

- Decide when you want to retire — common U.S. retirement ages are 62 (early Social Security), 65 (Medicare eligibility), or 67 (full Social Security benefits for most people).

- Imagine your desired lifestyle: staying in your current home, moving to a smaller one, traveling, or splitting time between states.

- Factor in location-based costs — retiring in Florida, for example, can have lower taxes than retiring in California.

Step 2: Estimate Your Retirement Expenses

- Break down essential costs (housing, healthcare, groceries, transportation) and discretionary spending (travel, hobbies, dining out).

- Don’t forget inflation — in the U.S., average inflation over the long term is about 2–3% annually.

- Include healthcare premiums, Medicare Part B, Medigap, or Medicare Advantage plans, plus out-of-pocket costs.

Step 3: Understand Your Income Sources

- Social Security — Create a “my Social Security” account at SSA.gov to estimate your monthly benefits.

- Pensions — If you’re one of the few with a pension, review your payout options.

- Investments — Include 401(k), IRA, Roth IRA, brokerage accounts, and other savings.

- Part-Time Work — Some retirees take part-time jobs or start small businesses for supplemental income.

Step 4: Maximize Tax-Advantaged Retirement Accounts

- Contribute to employer-sponsored 401(k) plans, especially enough to get the full match.

- Open and fund Traditional IRAs (tax-deferred) or Roth IRAs (tax-free withdrawals in retirement) depending on your tax situation.

- If self-employed, consider SEP IRA or Solo 401(k).

Step 5: Diversify Investments for Stability

- Keep a balanced portfolio of stocks, bonds, and cash equivalents.

- As you near retirement, gradually shift to lower-risk assets to preserve capital.

- Consider U.S. Treasury bonds or bond funds for stability.

Step 6: Plan for Healthcare & Long-Term Care

- Enroll in Medicare at age 65 to avoid penalties.

- Research supplemental coverage (Medigap) or Medicare Advantage plans.

- Consider long-term care insurance or set aside savings for potential nursing home or assisted living costs.

Step 7: Manage Debt Before Retirement

- Pay off high-interest debt (credit cards, personal loans) first.

- Aim to enter retirement mortgage-free if possible.

- Avoid taking on new large debts in your final working years.

Step 8: Understand Required Minimum Distributions (RMDs)

- From age 73 (as of 2025 rules), you must withdraw a minimum amount from Traditional IRAs and 401(k)s.

- Missing an RMD can result in a hefty IRS penalty (25% of the amount not withdrawn).

Step 9: Build an Emergency Fund

- Keep 6–12 months of living expenses in a high-yield savings account or money market account.

- This protects against market downturns so you don’t have to sell investments at a loss.

Step 10: Create or Update Your Estate Plan

- Make a will and, if needed, a trust.

- Update beneficiary designations on all retirement accounts and life insurance policies.

- Set up healthcare directives and a durable power of attorney.

Step 11: Track & Adjust Regularly

- Review your plan annually and adjust for changes in income, expenses, inflation, and market performance.

- Stay informed on changes in U.S. tax laws and Social Security rules.